Intellectual Property Securities Explained

An IPS can be considered as a fractional ownership of Intellectual Property, with a particular focus on Royalties payment right.

Investopedia defines a royalty as:

“A payment to an owner for the ongoing use of their asset or property, such as patents, copyrighted works, franchises, or natural resources. The legal owner of the property, patent, copyrighted work, or franchise receives a royalty payment from licensees or franchisees who wish to make use of it to generate revenue. In most cases, royalties are designed to compensate the owner for the asset’s use, and they are legally binding.”

The concept of a royalty payment is nothing new – they have been used in the music and film industries for decades now. Yet most people don’t consider yet that a royalty is actually a security. IPSe is active to gives to the owner certain rights.

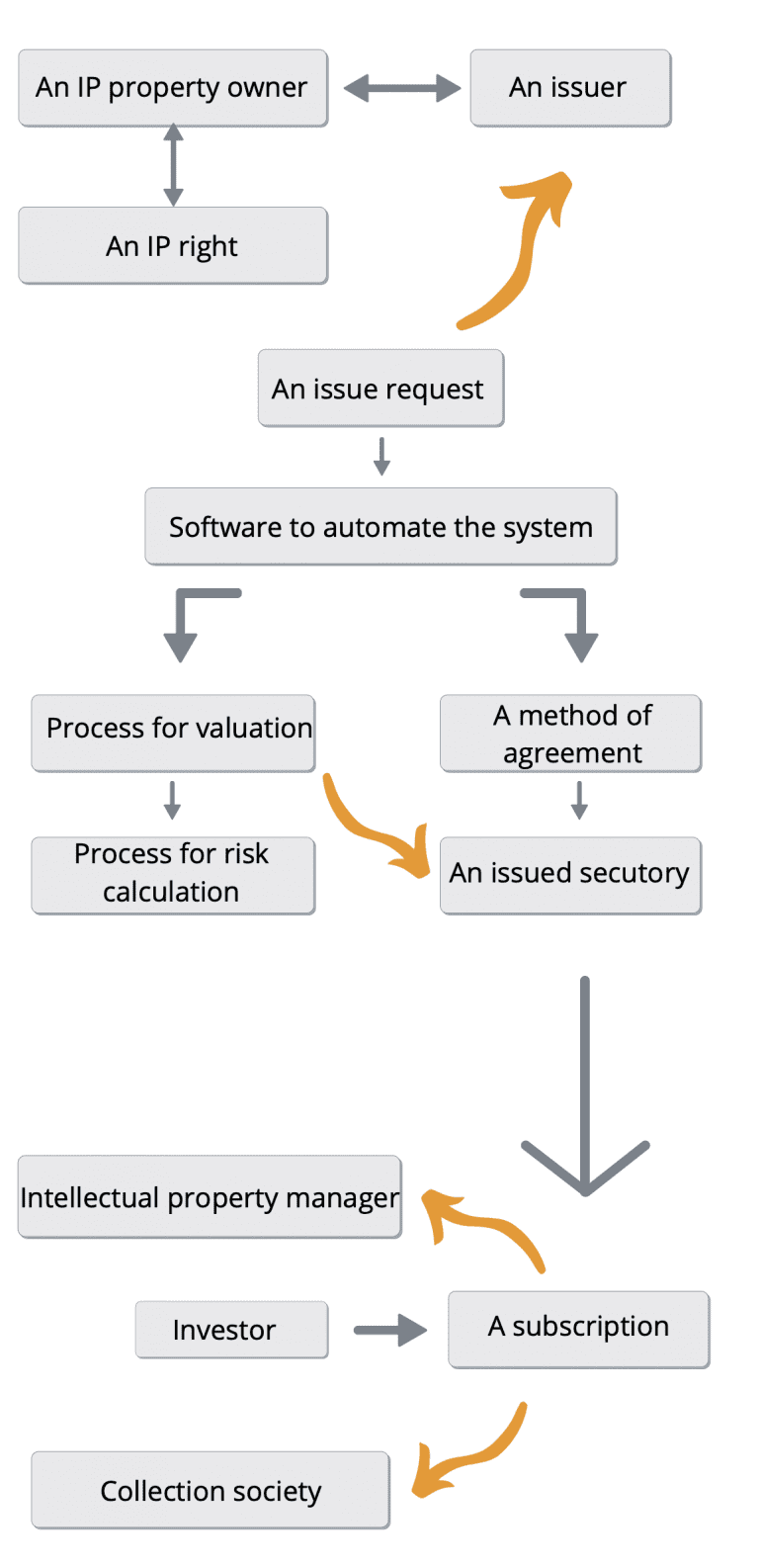

Previously it has not been possible to trade these rights in their current form, IPSe enables the creation of an Intellectual Property Security representing that right called an IPS.

The IPS itself can then be traded on a stock exchange that accepts IPS.

IPS will overlay the securities/license agreement, creating divisible units.

The overall license will typically reference a percentage of the gross or net revenues obtained using the owner’s property; that percentage is then broken down into a number of units, much like the shares in a company are split, representing the different ownership.

The use of royalties is common in situations where an inventor or original owner chooses to sell his or her product to a third party in exchange for royalties from the future revenues the product may generate. Royalty interests are the legal rights to collect future streams of royalty payments.

In the past, the only way to access these rights was to buy them as a commercial contract, but now they can effectively be packaged into a security offering and traded.

Because there are different types of royalties, the different uses, benefits and rights allocated to each owner of the royalty would need to be clearly defined.

To provide more context, here’s an example of a first type of IPS collecting royalties that could be listed on the NASDAQ:

“Computer manufacturers pay Microsoft royalties for the use of the Windows operating system in the computers they manufacture.

Payment may be non-renewable resource royalties, patent royalties, trademark royalties, franchises, copyrighted materials, book publishing royalties, music royalties, and art royalties.

Well-known fashion designers can charge royalties for the use of their names and designs by other companies.”

Third parties pay authors, musical artists and production professionals for the use of their produced, copyrighted material.

In the oil and gas industries, companies provide royalties to landowners for permission to extract natural resources from the landowners’ property.

IPSe makes it possible to buy a fraction of this right to royalty payments. The amount of Royalties collected fluctuate depending on the commercial success, yet it will be possible to simultaneously create an IPS that gives the IPS owner the ability to receive a right of income based on Intellectual property financial output.

The price of that IPS will rise and fall depending on various factors including the commercial success, the quality of of production, the amount of sales of the neighbouring rights and foreign exchange rates, etc. As a result, it is be possible to offer an investment-grade speculative product on an exchange that is different from equities and bonds.

The main advantage to the issuer is that equity in their business is not given away. Rather, it’s a purely commercial transaction in which the issuer can receive investment in advance in order to pay for key business development areas such as labour and equipment.

Unlike a variable coupon bond there is no redemption period (i.e. the investment is ongoing rather than maturing on a fixed date), meaning IPS works in perpetuity.

This can be advantageous to both parties the IP creator and the IPS Investor, insofar as there are no conditions that place an obligation to repay or an expiration date.

Effectively, it is a continuing obligation for the life of the issuing entity. If, however, the company wants to stop the arrangement, it will be obliged to repurchase IPS on the market and buy back its own income rights. IPS makes this possible because the contractual arrangements are held by IPSe, while the beneficial owners of that contract own the IPS.

Those IPS will likely fluctuate in value, and can be bought or sold in a secondary market. As the price rises and falls, the IPS holders can easily enter or exit the contractual agreement – something that was previously extremely difficult to do.

The presence of multiple counter parties makes the creation of an active secondary market possible, with buyers interested in acquiring more income-bearing royalties, and sellers wanting to trade out of their position.

Not only can IPS make markets more accessible and efficient, it provides the ability to fractionalise and seamlessly trade tangible all kind of Intellectual Property thereby opening up previously unimaginable possibilities to finance Arts and Science.

In addition, IPSe provides the opportunity to create new tradable asset classes. Replacing the middleman with a marketplace that provides ease of access and affordability to all shapes and sizes of investors – which indeed must be the definition of the democratisation of asset ownership.

IP Securities

Direct IP security: By investing in IP rights, investors become legitimate to have a percent relative to

Movie Securities

IPSE innovations is a novel way to providing a new source of capital to the entertainment industry

Music Securities

Investments on IP securities will also give to investors an entitlement of goodies linked to artistic, musical

Cinema & Shows Tickets

Investments on IP securities will also give to investors an entitlement of goodies linked to artistic, musical

Goodies

Investments on IP securities will also give to investors an entitlement of goodies linked to artistic, musical